By: Ajay Chhibber

By: Ajay ChhibberIndia’s rampant inflation remains a puzzle. Without a better understanding of inflation, policymakers are shooting in the dark and could end up making costly policy mistakes with huge unwanted consequences. India’s inflation has been persistently high and has risen in the last five years to the highest among all emerging economies, matched only by Vietnam. Global inflation and inflation in all other emerging economies have, in fact, fallen in the last years.

In its latest monetary policy announcement, the RBI has surprised markets by increasing the repo rate on concerns over inflation. Many experts and business groups have criticised the RBI as they assert that inflation is related to supply-side factors – especially in the food sector – and, therefore, tighter monetary policy will have little effect on it. Tighter monetary policy will only hurt growth without helping control inflation.

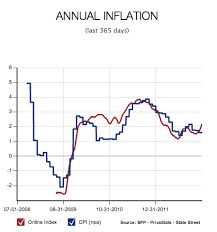

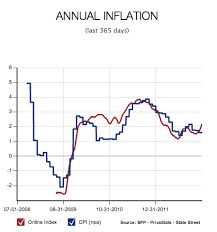

A complicating factor peculiar to India is the multiplicity of inflation rates. Should one target wholesale (WPI) or retail (CPI) inflation, or core inflation, which is defined as non-fuel, non-food inflation? In the past, WPI and CPI inflation moved closely together, so ambiguity on which rate to focus on was not such an issue. But over the last five years, they have diverged largely due to food inflation that has a bigger weight in the composition of the CPI.

So why is food inflation so high and why does it persist?

One explanation is that the procurement price for cereals has been rising very rapidly, above the rise in the cost of production. Over the last five years, the procurement price of cereals has increased over cost of production by almost 15-60% for a cumulative differential of around 150% over a five-year period. So, the food subsidy has doubled from around 40,000 crore in 2008-09 to over 80,000 crore in 2012-13, and is likely to rise further in 2013-14 as the new food Bill is implemented and the issue price at which grain is sold is reduced.

Release Grain, Now

The rapid increase in purchase prices has two effects: it increases the offtake of grain from the market and increases grain prices in the open market, and it increases the food subsidy Bill that adds to the fiscal deficit and, thereby, fuels inflation.

The government has not released grain above the buffer stock norms and we have seen the most perverse outcome of rising food stocks and rising food inflation. Instead of releasing grain in the open market to reduce prices, India arranged the largest export of grain ever in its history in 2012-13, exporting 10.1 million tonnes of rice, 6.5 million tonnes of wheat and 4.8 million tonnes of corn as domestic prices were below international prices.

One option now, as another bumper crop is expected in 2013-14, is to switch from an open-ended grain purchase policy to a policy of only procuring what the government needs for its PDS and buffer stock. This will mean more grain will be left in the market and government stocks will decline over a period of one year. Selective imports of pulses and oilseeds may also help contain inflation.

Another factor is rising farm wages ascribed to tightening labour market due to the NREGA programme. Rural wages have risen; this explains declining poverty despite rising food prices – but they also contribute to higher costs of production – especially for vegetables, onions and horticultural crops. The solution here is to find less-labour-intensive methods of production that are consistent with higher rural wages.